On 17 February 2026, a webinar was held for participants in the ProfTime project of the Al-Terra International Methodological, Training and Examination Centre for Professional Business Qualifications and Standards as part of the EU Erasmus+ Jean Monnet Module project ‘Fostering a sustainable interest in EU tax culture through educational, scientific and communication awareness-raising activities targeting Ukrainian society’.

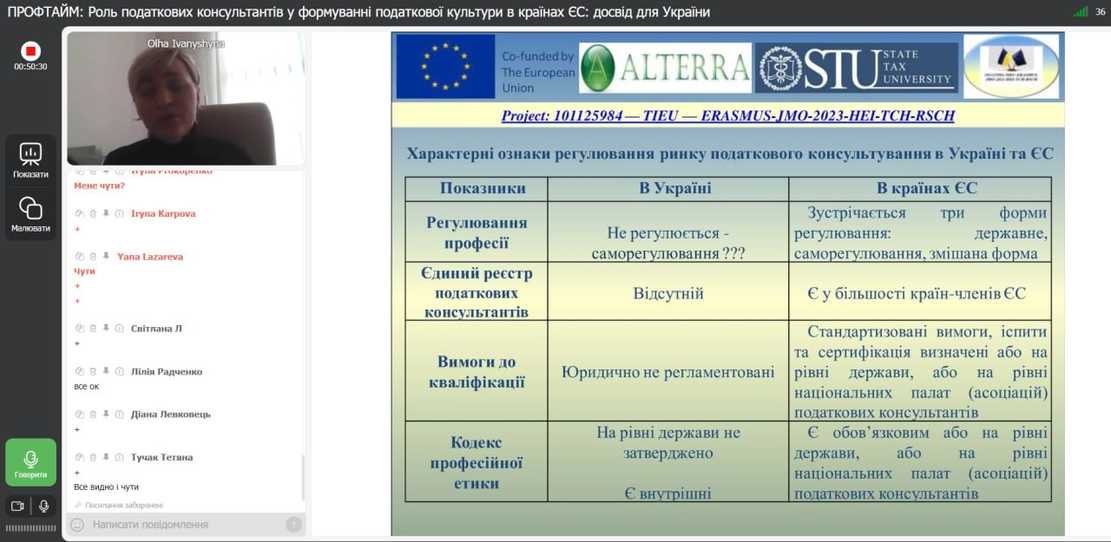

During the event, speakers Olga Ivanyushina, Ph.D., Associate Professor, Head of the Tax Administration Department of the Faculty of Taxation, Accounting and Auditing of the State Tax University, and Iryna Prokopenko, Ph.D. in Economics, Associate Professor of the Department of Tax Administration, familiarised participants with the specifics of the professional activities of tax consultants in EU countries and analysed models of regulation of the profession using the example of individual EU member states. Particular attention was paid to the impact of tax consultants on the formation of tax culture, ensuring voluntary tax discipline, and the important role of tax consultants in EU countries as intermediaries between taxpayers and tax authorities.

The webinar analysed the current state of tax advisory services in Ukraine and proposed ways to implement European experience in order to develop the institution of tax consulting, improve the quality of tax support for business, and reduce the level of shadow economy.

Webinar participants actively joined in the discussion of problematic issues in the field of tax advisory services in Ukraine and the prospects for the development and regulation of the profession, as well as enhancing the role of the professional community of tax advisors in Ukraine, taking into account the experience of the EU.