Students of the Educational and Scientific Institute of Law of the State Tax University attended a lecture course titled “European Law: European Tax Law,” organised by the initiative of the Department of International Cooperation of STU. The guest lecturer was Dr Lars Miker, Professor and Director of the Institute of International Tax Law in Nordkirchen, Germany. The meetings were moderated by the Head of the Department of Legal Linguistics and Doctor of Juridical Sciences, Viktoriia Mykolaets.

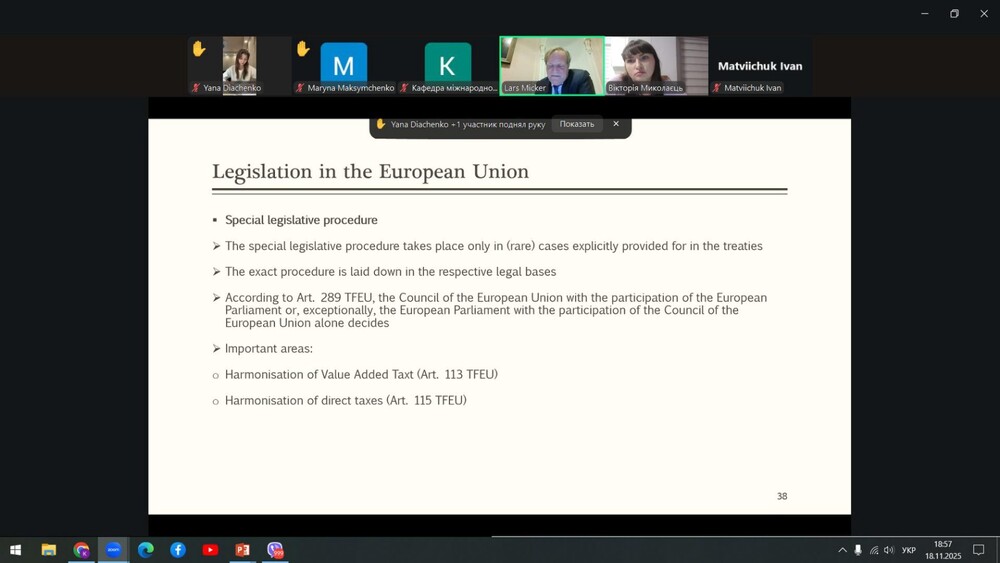

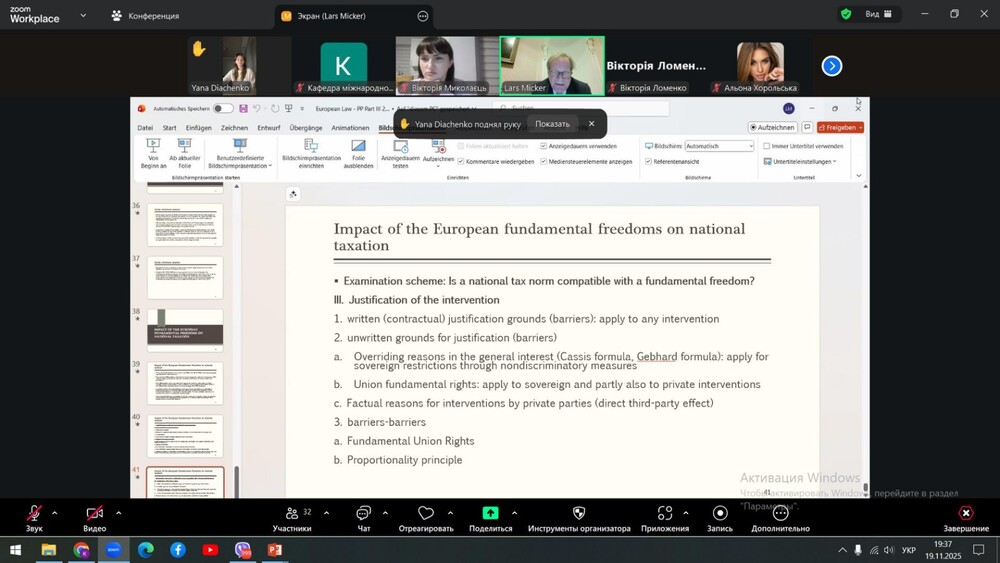

During the lectures, students became familiar with the history of the formation of the EU legal framework and the mechanisms for monitoring compliance with Union legislation. Particular attention was given to the impact of European law on national tax legislation through EU directives.

A key conclusion of the course was an understanding of the primacy of EU law over the laws of member states. The European Court of Justice ensures compliance with the fundamental freedoms of the internal market — free movement of goods, capital, labour and freedom of establishment — by issuing binding decisions for member states.

Each topic included a practical component in which the lecturer prepared case studies for students to analyse, discuss and present their own positions and propose possible solutions. This approach encouraged active dialogue and student engagement.

We would like to thank Professor Lars Miker for an insightful course that helped students gain a deeper understanding of the European legal environment and its influence on tax policy.